More clarity means less stress. Life is a series of ‘what if?’ questions.

See how the LifeLens financial forecasting tool can help you eliminate hesitancy, uncertainty and anxiety from your financial decision-making.

Enjoy a clear view of your financial future.

with LifeLens—the most comprehensive financial

forecasting tool on the market.

LifeLens is powerfully complex. Using it is not.

The LifeLens financial forecasting tool uses 40,000 distinct calculations to provide you with a deep, detailed understanding of your financial outlook—now and for the rest of your life. While this may seem complicated—and it is—the user experience is anything but. LifeLens factors in every aspect of your finances and provides you with a straightforward, lifetime summary complete with explanations, notifications and simple recommendations. Living a life of financial freedom has never been this easy.

Versatile and indispensible—the perfect tool for everyone.

ESTATE PLANNERS

This easy-to-use tool helps estate planners empower their clients with meticulous financial insight for the rest of their lives and beyond.

COLLEGE GRADS

By revealing the financial implications of a variety of life choices and hypotheticals, LifeLens removes uncertainty for a college grad’s transition into the workforce.

HOME BUYERS

Equip yourself with a clear understanding of the financial pros and cons of homeownership and take the anxiety out of the homebuying process.

SINGLES / WIDOWED

Providing the singles or widows in your life with a LifeLens subscription gives them the gift of financial certainty and peace of mind.

FAMILIES

Ever-changing family finances can feel like a rollercoaster. LifeLens helps provide stability and confidence, no matter how your family grows over the years.

NEWLYWEDS

Newlyweds can start their marriage off on the right foot—and the same page—by sharing a complete understanding of their financial outlook.

CHARITABLE GIVERS

The advanced modeling and planning capabilities offered by LifeLens helps you live a life of comfortable, fullhearted giving.

RETIREES

Everyone deserves a relaxing, stress-free retirement. Remove financial strain from your retirement years with precise planning from LifeLens.

Chances are, your financial future is brighter than you think.

Your full financial picture, at your fingertips.

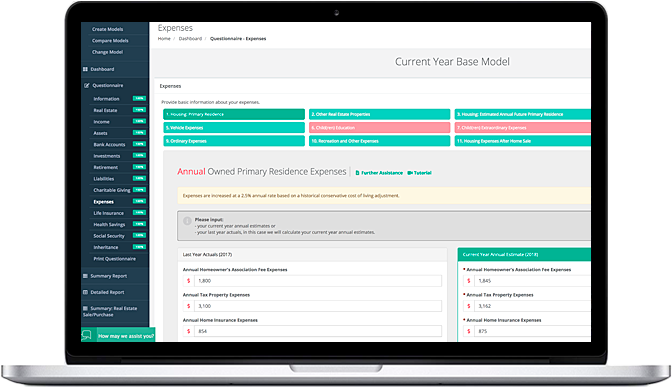

QUESTIONNAIRE

You’ll begin by answering 13 categories of questions so LifeLens can learn more about your expenses, assets, liabilities and lifetime goals.

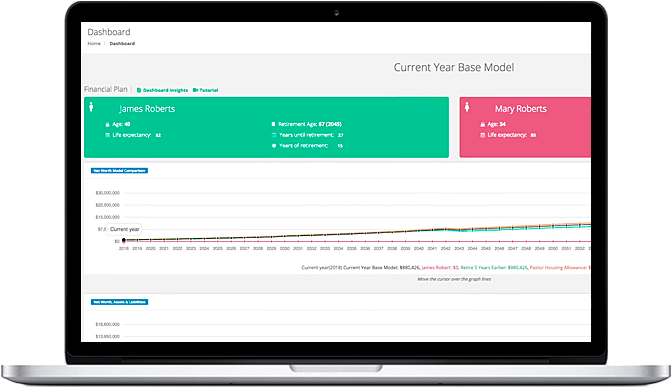

USER-FRIENDLY DASHBOARD

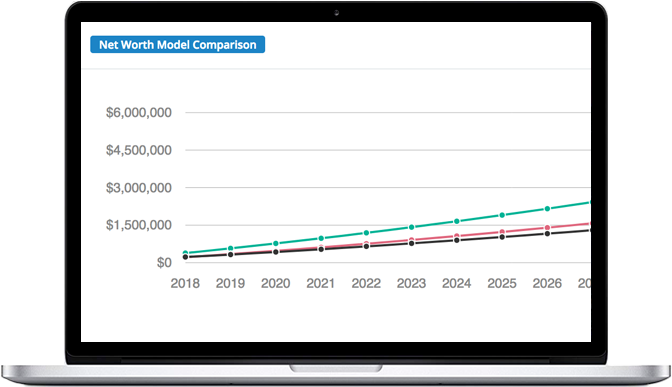

All through one easy-to-use dashboard, you can view colorful, interactive graphs that show how your life decisions will affect your lifetime finances and net worth.

COMPLETE REPORTING

Using more than 40,000 calculations, LifeLens will provide you with a year-by-year summary report and a detailed projection of your complete financial picture for the rest of your life.

CONTROL YOUR FUTURE

With clear and powerful modeling capabilities, you can answer all of life’s big “what if” questions with clear-eyed confidence. You’ll understand exactly how your finances would hypothetically fare with every big life choice or potential catastrophe.

Calculate your net worth for free.

You’re not in this alone.

Financial planning can feel daunting, but we’re here for you every step of the way. If you feel stuck or uncertain at any point, get in touch using chat assistance, consult with a LifeLens financial expert,or use our library of video tutorials and further assistance narratives within our planning tool.

Your data is safe and secure.

You can rest easy knowing that we employ data encryption, password protection and a state-of-the-art security system to protect your privacy and safeguard your financial data.